‘Just talk to all of these $100k+ earners moving out – they feel that they are overpaying their fair share’

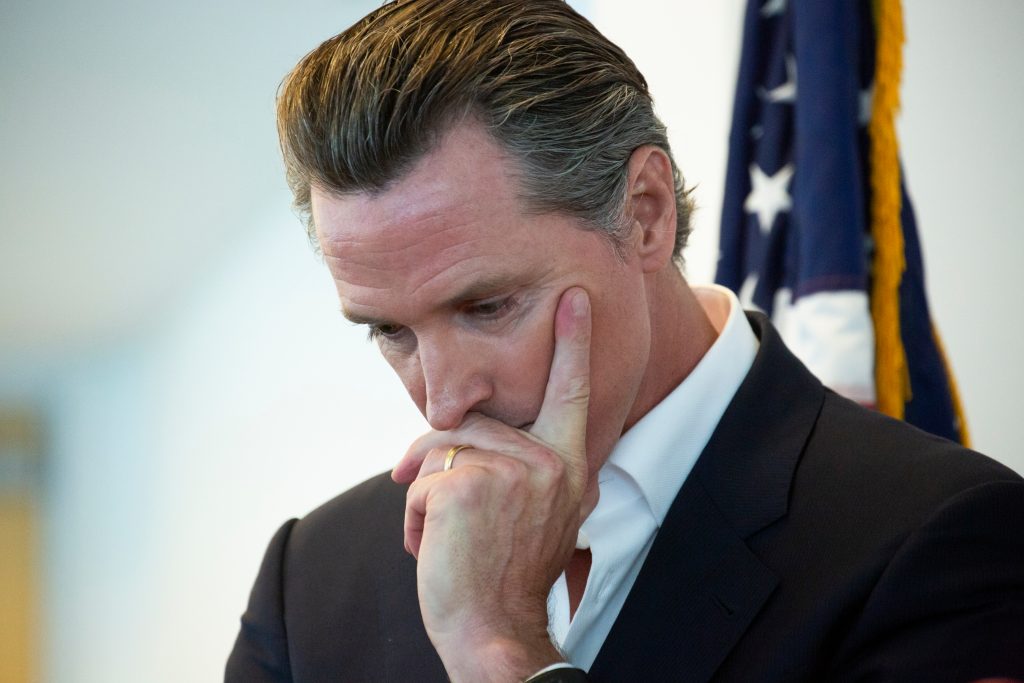

Governor Gavin Newsom announced his opposition to the AB 259 by Assemblyman Alex Lee (D-Silicon Valley), the wealth tax bill earlier this week, cementing that the bill would ultimately not be passed this year even if passed by both the Assembly and Senate.

While Newsom has backed tax increases in the past, he has had a history of not imposing wealth taxes, or taxes imposed by the state based on the assets of an individual. One of Newsom’s largest stands against a wealth tax came in 2020, when he vehemently came out against AB 2088. At the time, Newsom said that “A wealth tax is not part of the conversation. Wealth tax proposals are going nowhere in California.â€

In 2022, Newsom surprised many people once again by coming out against Prop 30, a ballot initiative that would have raised taxes on wealthy Californians to fund wildfire management and electric car incentives. Prop 30 ultimately failed in November in a landslide 58%-42% vote.

On Wednesday, Newsom continued his opposition to wealth taxes with a statement from his office confirming that he will continue to oppose new wealth taxes, including AB 259. Despite the bill being more “modest†in what it would tax – namely imposing an annual worldwide net worth tax of 1 percent on net worth above $50 million, rising to 1.5 percent on net worth over $1.0 billion – compared to previous bills, the Governor is still laying down the gauntlet.

But why? Newsom’s constant fight to introduce a wealth has raised the eyebrows of many on the left, including the odd team-ups that came as a result. For example, opposition against Prop 30 last year was made up of, among others, the Governor, the California Republican Party, the California Teacher’s Union, and the California Chamber of Commerce. And this time around with AB 259, Newsom finds himself on the opposite side of unions.

One of the big reasons has been California’s large surpluses in recent years. With so much revenue coming in, a wealth tax really wasn’t needed. Another reason has been Newsom’s focus on the “welfare and fiscal health of the entire state.†While that sort of phrase can mean anything, it comes down to the fact that 700,000 Californians have left the state since the 2020. Coupled with many businesses pulling out as well, a major wealth tax would only worsen this exodus, causing California to lose out on even more income than the wealth tax would bring in. Newsom has said on many occasions that he is worried about what such an increased exodus would do. Even with the state facing a $22 billion deficit, Newsom, as well as many other lawmakers, cannot justify pulling the trigger on such a tax.

While there are some other wealth tax proposals up there, including a proposed Constitutional Amendment currently in the Assembly and a 2024 proposition that’s planned to be on the ballot, Newsom has continued to be a strange ally amongst those fighting wealth taxes in California.

“It doesn’t take a genius to see why a wealth tax would just be terrible for California,†John Lemkow, a wealth advisor in the Bay Area who has had many clients move out of the state in recent years, told the Globe on Friday. “Just talk to all of these $100k+ earners moving out. It’s being squeezed. It’s because they feel that they are overpaying their fair share. It’s because they don’t like how their tax dollars are being spent here. It’s because they can’t grow their businesses here.:

“Many are barely staying here, and I’ve heard from many that one more big tax increase, or should I say, one more targeted tax increase, would be the final straw for them. It’s easy for some people to shout ‘Tax the rich’, but guess what? Tax them too much, they leave, and you have even less money coming in than before. Now, a lot of people in California realize them. Republicans, some Democrats of course, and Newsom of all people. There’s a lot you can pin on Newsom. But even he knows that big taxes aimed at wealthy Californians would only make the situation worse.â€

AB 259 is considered unlikely to be passed this year.