Prop 5 will help local leaders hand out bigger checks to government employees under the guise of public works, warns Howard Jarvis Taxpayers Ass’n spokesperson Susan Shelley in this Opp Now exclusive Q&A. With major ambiguity and little accountability, the measure will ease through almost any kind of local bond that fits the new, open-ended “infrastructure” definition—while existing budgets are siphoned up for salaries. What’s more, “housing” under Prop 5 now includes down payment handouts.

Opportunity Now: Is there bipartisan opposition to Prop 5?

Susan Shelley: I wouldn’t characterize it as a partisan issue, so much as it is a government-versus-the-taxpayers issue.

All of the agencies that receive government money, every organization that is paid with tax money wants the ability to make it easier to raise taxes.

So, it’s the city, county, and state governments. It’s all the different agencies. It’s all the contractors and unions that would receive funding, the developers that would receive funding, anybody who’s going to be paid with tax money—they want to make it easier to raise your taxes.Sign up to receive updates on Opp Now articles. Click HERE.

ON: Well, it’s not quite all the local governments. Gilroy City Council voted not to support Prop 5.

SS: That’s excellent. I may have to move to Gilroy if they’ve got a government that’s that smart.

But on the other hand, the League of California Cities, the California State Association of Counties, the California Special Districts Association—the list of people who want to raise your taxes and take your money is very long.

And who’s against this? The taxpayers.

ON: When you say taxpayers, you mean people who have to pay property taxes. Doesn’t that mostly affect homeowners?

SS: Higher property taxes are passed through to everybody.

They’re passed through to tenants, because the apartment buildings are hit with these extra charges on their property tax bills.

It raises consumer prices, when commercial property faces higher taxes.

Even the smallest little store in a strip mall will have those higher property taxes passed through, raising their costs, contributing to higher prices and a higher cost of living.

So everybody winds up paying these property taxes, not just homeowners.

ON: What kind of bond measures are we talking about?

SS: So-called infrastructure, which is everything, even if you pour a little puddle of concrete next to a pay raise, it’s infrastructure.

ON: Haha. What does that mean?

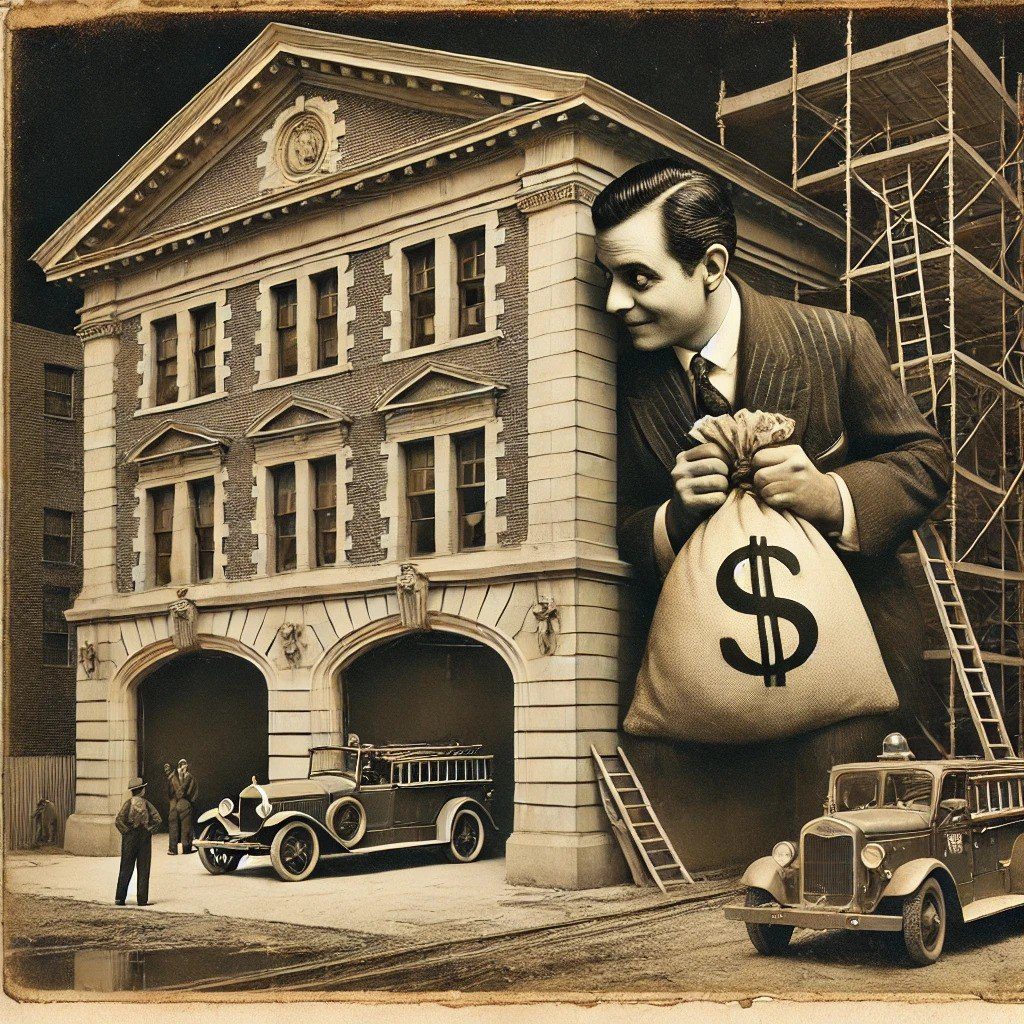

SS: Local governments will never put something on the ballot that voters don’t want. What some of them will do is they’ll spend the money they have on pay raises. Then, they’ll put something on the ballot for fire stations. So, it will always sound essential. It will always sound like, “If we don’t do this [issue bonds that raise property taxes], there’s no money for it at all.”

ON: So infrastructure bonds will be spent on pay raises?

SS: Money is fungible. When it’s easier to issue bonds and borrow money, they can then spend their current budget on something voters would never vote for.

When there’s something that people would vote for, like a new library or fire station, governments don’t have to use the existing tax revenue to do that. Instead, they can put that on the ballot, and many voters will vote for it because it’s borrowed money.

They don’t think they’re going to be paying for it. But bonds are the most expensive way to pay for anything, because of the long-term interest payments.

ON: I see. Aside from infrastructure, what other kinds of bonds does Prop 5 make it easier to pass?

SS: They also want to add in this government housing component, which is not just buildings, but also programs such as down payment assistance.

There’s language in Prop 5 that could be used to justify borrowing for virtually anything.

And the reason I think that’s significant is because they’re trying to tell the voters that there’s oversight and there’s audits and there’s accountability, but that’s within the scope of what they’ve written there.

So if the money can be used for things “including, but not limited to,” it’s going to pass an audit no matter what they do.

Follow Opportunity Now on Twitter @svopportunity